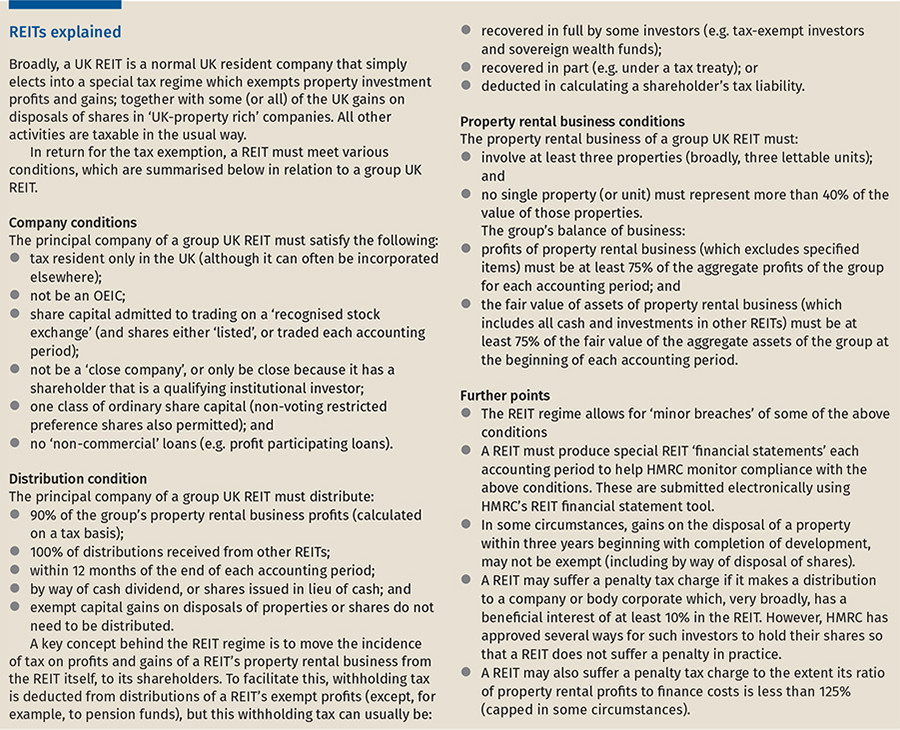

reit tax benefits uk

If completing the return online in the section Other UK Income tick. Your REIT Income Only Gets Taxed Once When a typical corporation makes.

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

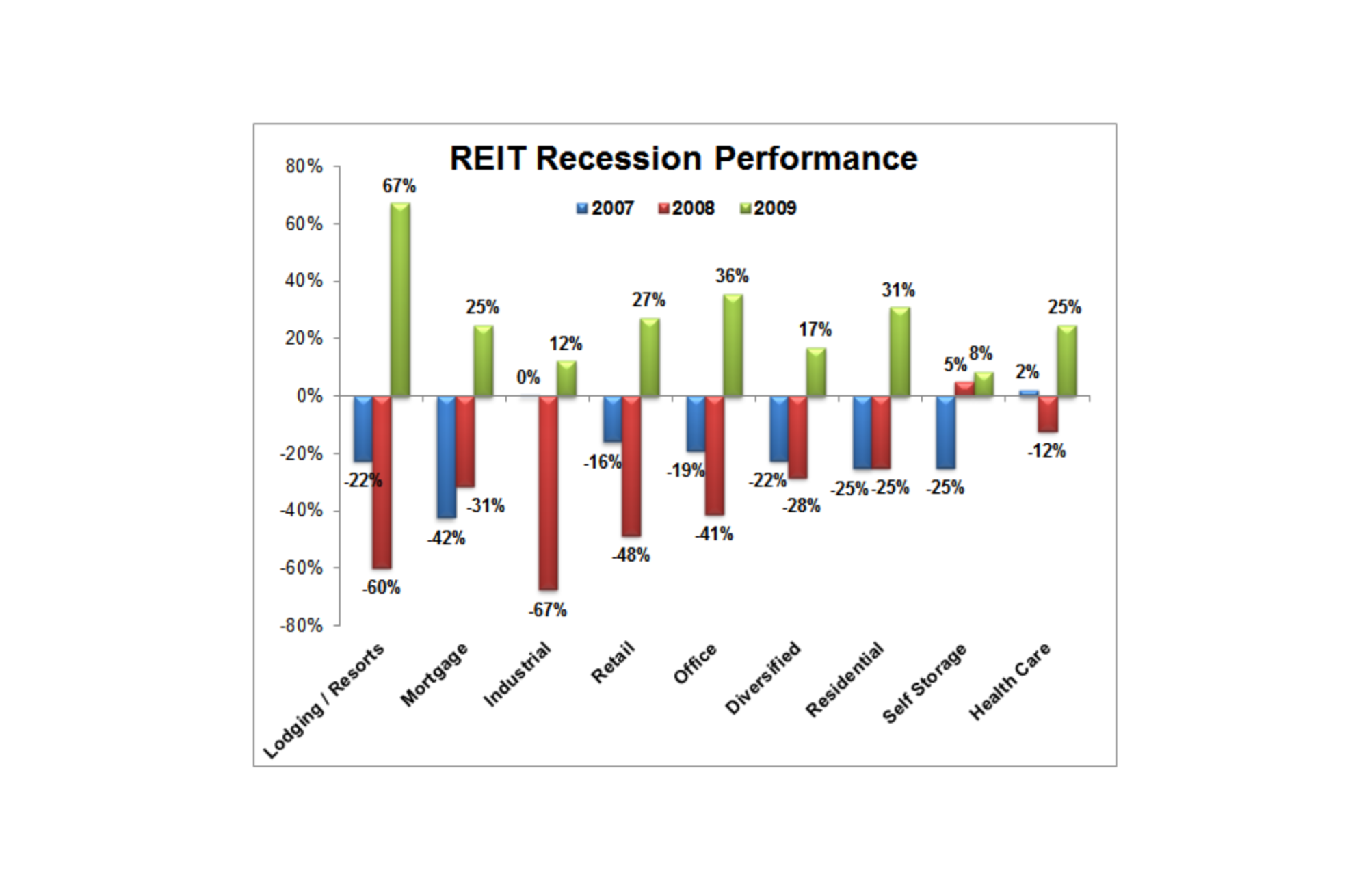

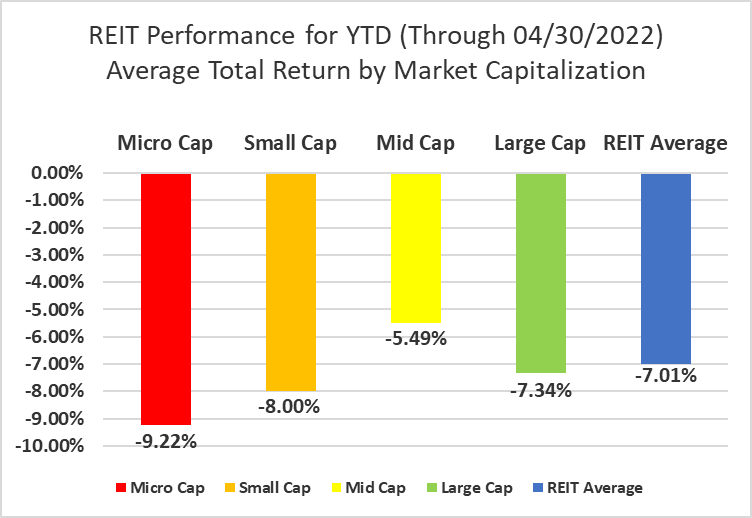

Does the down market have you down.

. The REIT is exempt from UK tax on the income and gains of its property rental business. Both the profits and financing costs are calculated in. This allows it to benefit from exemptions from UK corporation tax on profits and gains.

A UK-REIT is exempt from UK corporation tax on profits both income profits and capital gains arising from carrying on a qualifying property. REITs present a potentially tax-efficient option for investors because it is possible to purchase them through efficient accounts. The REIT makes a distribution to a corporate shareholder that is beneficially entitled to 10 or more of its shares or dividends or that controls 10 or more of its voting.

Ad Investing in Real Estate Can Be Lucrative. The benefits are considerable. REIT Tax Benefits No.

In the hands of the shareholder property income distributions PID are taxable as profits of a UK. A UK REIT needs to carry on a property rental business and meet the various conditions for REIT status. In particular many investors could.

You can hold investments in REITs in any kind of. Tax benefits of REITs Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. Youll pay at least 90 of your property rental business income to shareholders each year your investors will be taxed on this income as if theyve received.

Here are three big tax benefits you get when you invest in REITs. REITs provide unique tax advantages that can translate into a steady stream of income for investors and higher yields than what they might earn in fixed-income markets. It offers exposure to a portfolio of Urban and Big box warehouses in Europe with a combined value of 184b.

We have top picks to help you weather the storm. After tax return from UK company After tax return from UK REIT Enhancement of return UK pension fundsISAs SIPPs and Sovereign wealth funds 75 100 333 Overseas investor. Individual REIT shareholders can deduct 20.

Advantages of REITs In this chapter we will go through the main advantages of investing in REITs. In their simplest tax form a REIT functions like a hybrid of the two and provides the best. The largest UK REIT is Segro SGRO with a market cap of 124b.

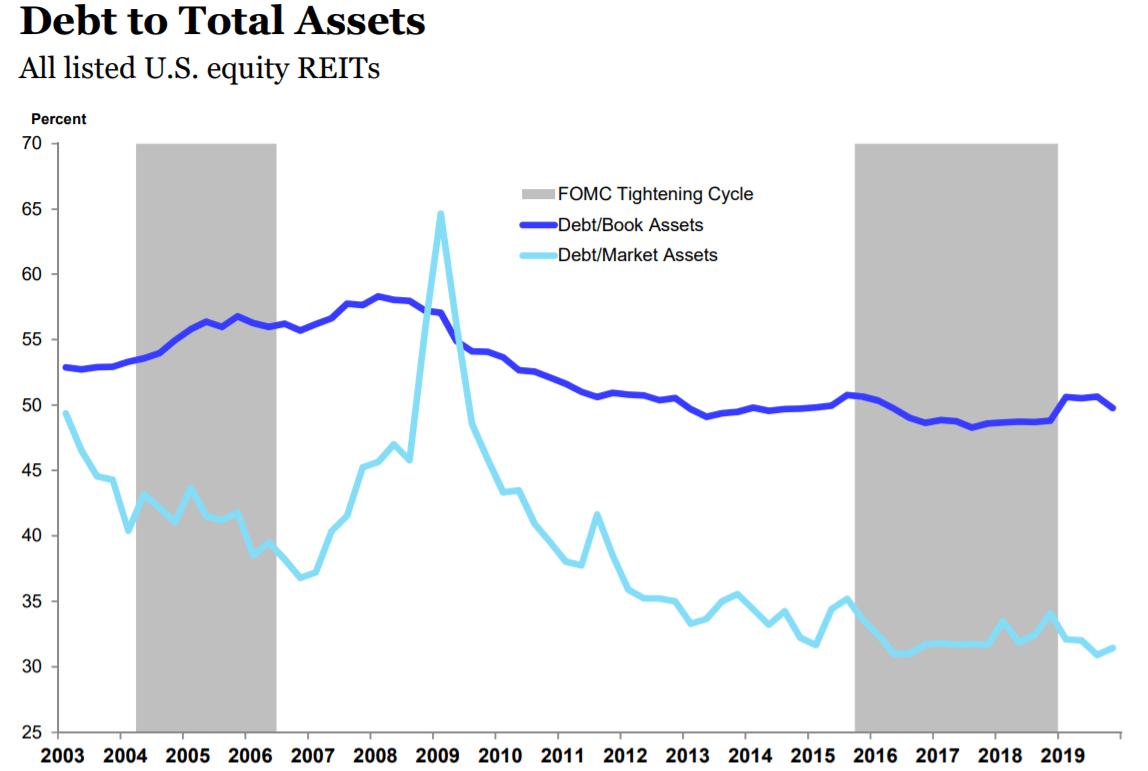

The UK REIT regime uses a ratio test that compares profits of a UK REITs tax-exempt business with its financing costs. The announcement that the UK corporation tax rate is to increase from 19 to 25 from April 2023 has created a renewed buzz of interest in REITs. For UK resident individuals who receive tax returns the PID from a UK REIT is included on the tax return as Other Income.

REITs are taxed as a corporation but are also afforded some of the benefits of a flow through entity. A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received. As a REIT.

How to Get the Benefits Without The Headaches. Advantages include diversification tax efficiencies and ability to invest in assets that might.

Taxation Of Reits Ringing In The Changes

Top Reasons To Not Invest In Reits Seeking Alpha

Reits A Force For Good Crestbridge

How To Invest In Reits In The Uk Raisin Uk

Reits Vs Real Estate Mutual Funds What S The Difference

10 Years Of Uk Reits From Bad Timing To Better Times S P Global Market Intelligence

.png)

Are These The Best Reit Stocks Etfs In The Uk Ig Uk

What Are The Best Reits To Invest In United Kingdom Investing Strategy Safe Investments Marketing Jobs

The State Of Reits May 2022 Edition Seeking Alpha

How To Invest In Reits And Why

What Are Real Estate Investment Trusts Reits Benefits And Challenges

How To Invest In Reits In The Uk Ig Uk

How Reit Regimes Are Doing In 2018 Ey Slovakia

Reits A Diversification Trilogy Financial Times Partner Content By Janus Henderson

What Is An Reit And Is It A Good Investment

Reit Dividends And Uk Tax Assura

A Short Lesson On Reit Taxation

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide